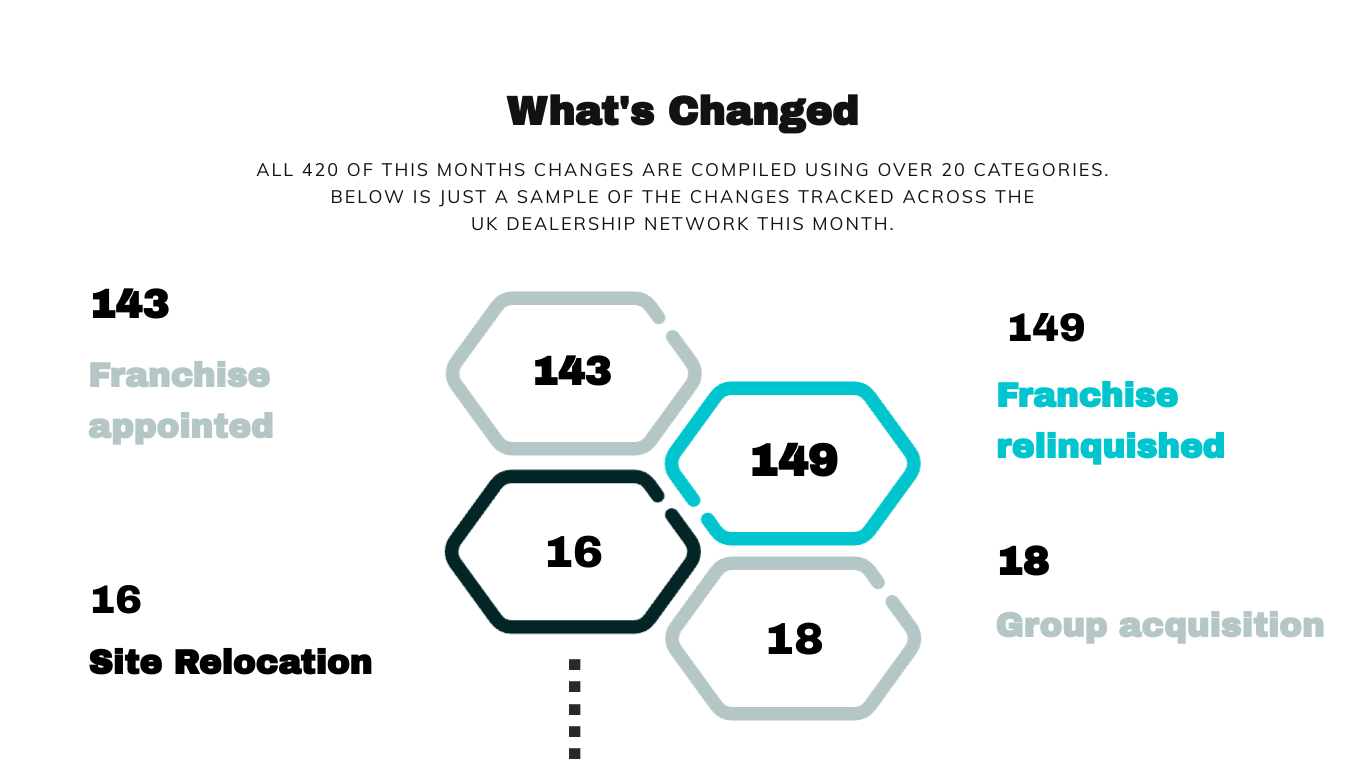

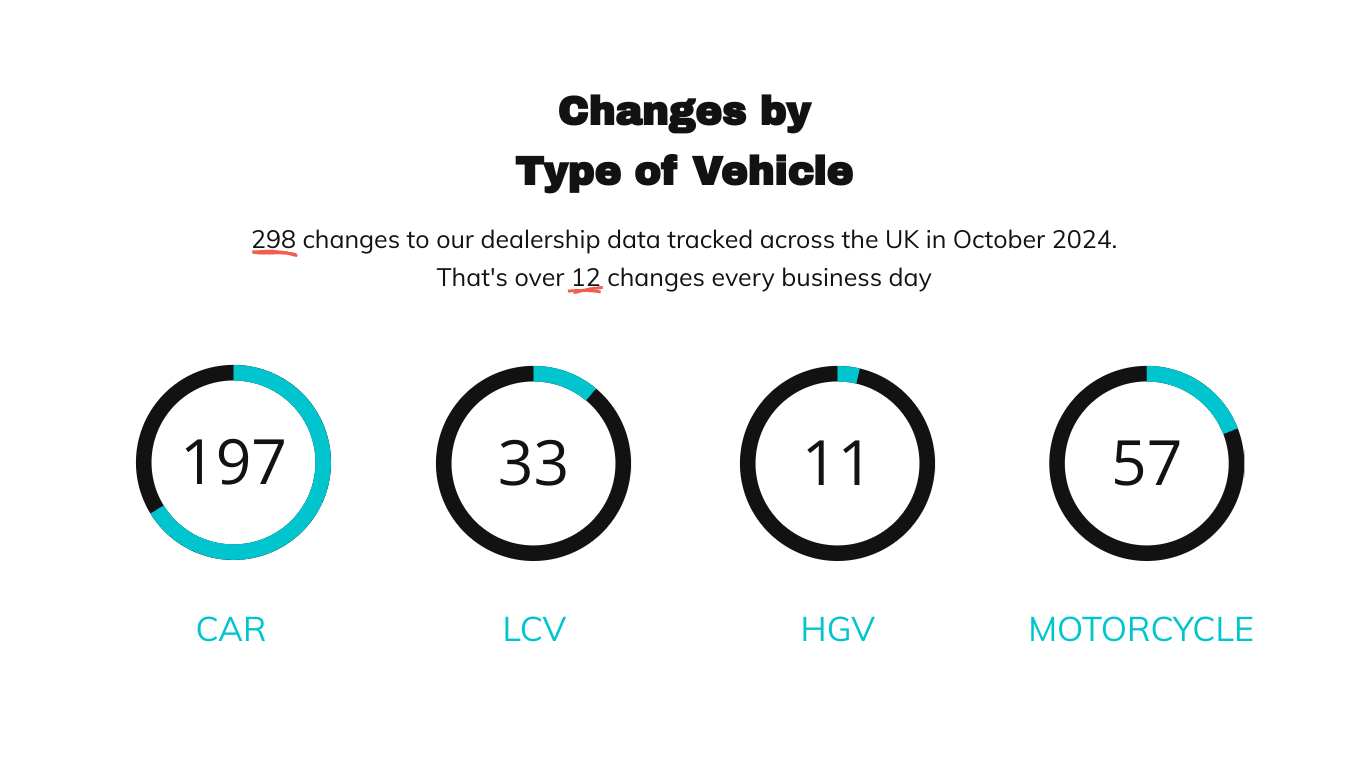

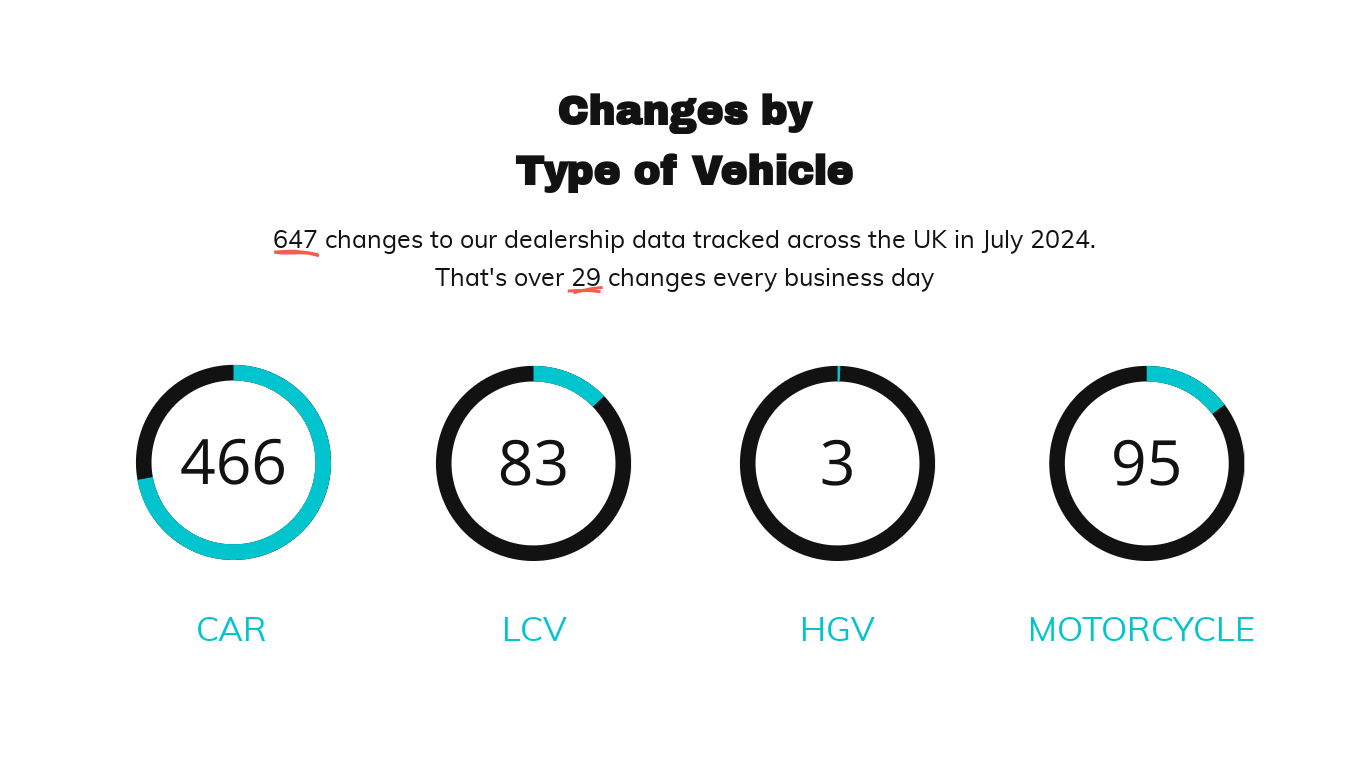

Dealership Movements by Vehicle Type

Breakdown of franchised dealership openings and closures by vehicle type in April 2025, including cars, commercials and motorcycles.

Cars and commercials remain prominant, but this image clearly highlights modest activity in the motorcycle segment too. There's a noticeable volume of car dealership changes, with more brands making decisions around their car-focused representation than any other type. Overall, movement is slightly less this month than March (445 vs 505). But still, a not too shabby 22 changes per business day.

Geographic Distribution of Changes

A map highlighting where dealership openings and closures occurred in the UK during April 2025

This month’s distribution shows a concentration of network activity in England’s heartland, especially the Midlands. Pockets appear along the North and South coastal regions, but there’s a wide national coverage in terms of dealership data changes.

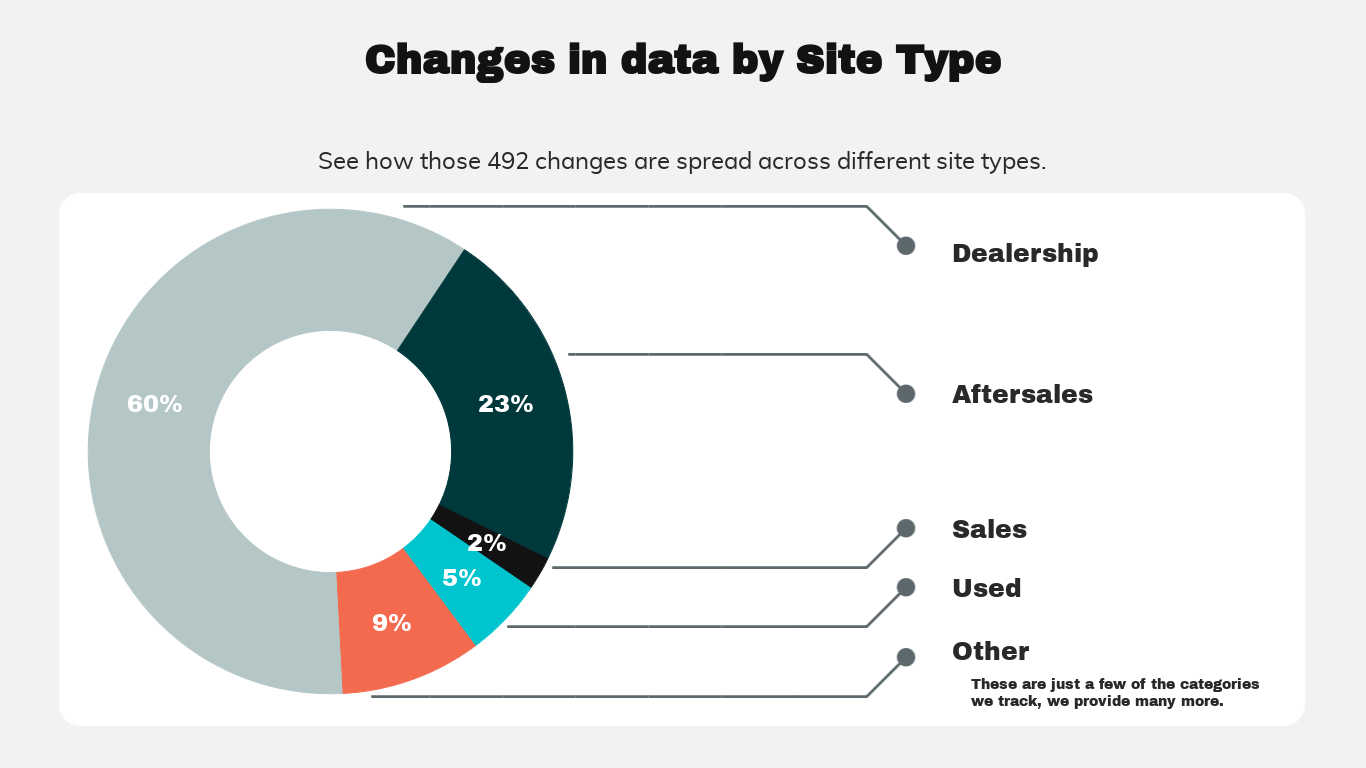

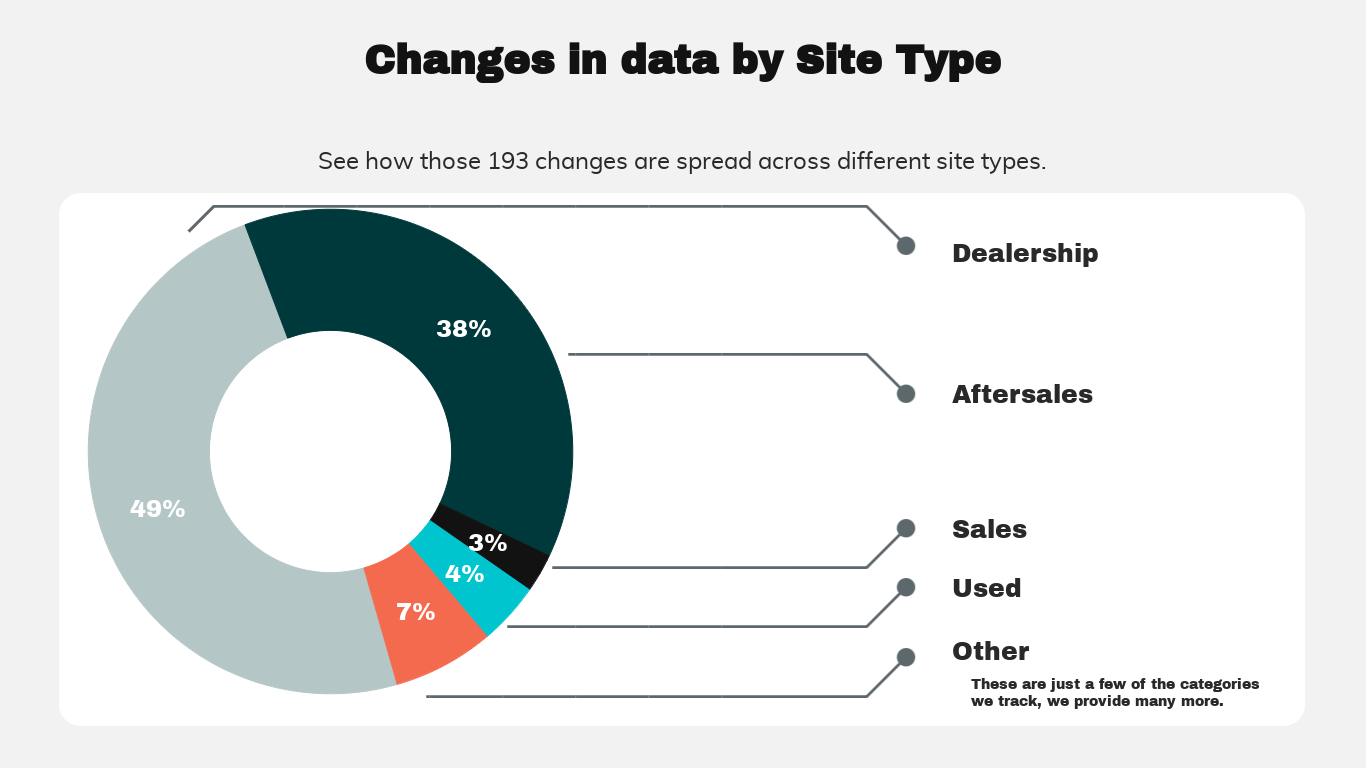

Changes in Data by Site Type

Visual showing how dealership openings and closures were distributed across different franchised site types

The site type breakdown gives insight into which operational formats are gaining ground. Certain dealership formats saw increased activity, particularly among multi-purpose (sales & service franchised outlets.

Franchise Movements – Who's In and Who’s Out?

Chart highlighting the number of new franchise appointments versus relinquishments across dealership categories in April 2025

There’s strong evidence of strategic restructuring, with more franchises being relinquished than newly appointed in certain categories. Other segments show a more balanced shift, suggesting brand realignment rather than expansion.

Ask JS Management

Question:

Which vehicle category saw the most dealership activity in April 2025?

Answer:

Based on April’s figures, car dealerships accounted for the majority of network changes, followed closely by commercial vehicle outlets. Motorcycle networks were active, suggesting varied brand strategies across segments.

Final Thoughts

April’s charts tell a story of targeted shifts rather than sweeping change – with most activity likely driven by regional strategies. Whether you’re planning network expansion, competitive tracking, or supplier targeting, this month’s data shows where the movement is happening – and where opportunity could be next.